Paul Biya, young voters and his AI-campaign video backlash

Paul Njie BBC Africa, Yaoundé

AFP/Getty Images

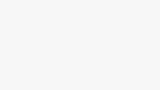

AFP/Getty ImagesThe world’s oldest head of state – 92-year-old Paul Biya – has promised Cameroon’s electorate “the best is still to come” as he seeks his eighth consecutive presidential term on Sunday.

The nonagenarian has already been in power since 1982 – another seven-year mandate could see him rule for 50 years until he will be almost 100.

He defied widespread calls to step down and has been criticised for only showing up for one rally, spending most of the campaign period on a 10-day private trip to Europe.

A backlash over his reliance on an AI-generated campaign video, as his opponents actively wooed voters on the ground, saw him rush north on his return home.

In the vote-rich city of Maroua on Tuesday he addressed crowds of his party supporters – reaching out in particular to women and young people, promising to prioritise their plight in his next mandate.

“I will keep my word,” he insisted, urging them to “give me your valuable support once again”.

But political analyst Immanuel Wanah tells the BBC that Biya’s primary focus since coming to power has been to stay in power, “often at the expense of efforts to enhance the living conditions of the country’s citizens”.

It is a view echoed by Dr Tilarius Atia, another political analyst, who puts this survivalist mindset down to an abortive coup against Biya in 1984.

It means that for the vast majority of the population, Biya is the only president they have known – more than 60% of Cameroon’s 30 million people are below the age of 25.

Young political activist Marie Flore Mboussi is desperate for “new blood” as she believes “longevity in power inevitably leads to a kind of laziness”.

“After 43 years, the people are tired,” she tells the BBC.

The presidential election comes amid growing concerns about inflation, security challenges, poor social services, corruption and unemployment.

Youth unemployment has been a particular talking point for most of the candidates running in the election.

Nearly 40% of young Cameroonians between the ages of 15 and 35 are unemployed, with 23% of young graduates facing challenges in obtaining formal employment, according to the International Organization for Migration (IOM).

“Young people are more inclined to emigrate abroad because they tell themselves that inside the country, they do not have the possibility of becoming somebody,” 26-old-year graduate Vanina Nzekui tells the BBC.

“They tell themselves that all positions are occupied by older people,” she says, adding that this comes at the cost of using their skills to help develop the country.

But Aziseh Mbi, 23, believes age should not be a criterion for leadership.

In Biya’s case, the civil society activist says, the president has been able to do “significant things,” citing several youth initiatives.

Reuters

ReutersBeyond youth unemployment, the electoral process has also stirred controversy, especially with the exclusion of Maurice Kamto from the presidential race.

In July the electoral body barred the 71-year-old opposition leader from running because a rival faction of the party that had endorsed him presented someone else as a candidate.

His exclusion, confirmed by the Constitutional Council, was widely criticised as a ploy to prevent any strong challenge to President Biya.

After coming second in the 2018 presidential election, Kamto claimed victory and organised street protests.

“The exclusion of Prof Kamto waters down the legitimacy of our democracy because we should have been fair enough to allow for everybody to partake,” says Dr Atia.

Mr Wanah agrees that the absence of the country’s main opposition figure “reinforces the perception that truly fair elections cannot take place in Cameroon”.

Twelve candidates were approved to contest for the country’s top job, including Issa Tchiroma Bakary and Bello Bouba Maigari – both former Biya allies from the north of the country. They resigned from their ministerial positions in government to take on their boss.

Lawmaker Cabral Libii, chairman of the opposition Social Democratic Front (SDF) party Joshua Osih and Patricia Tomaïno Ndam Njoya – the lone female candidate – are also in the race.

At the launch of the election campaign, two aspirants, including renowned anti-corruption lawyer Akere Muna, withdrew their candidacies to support Maigari of the NUDP party. This means 10 people will now compete for the presidency.

Michel Mvondo / BBC

Michel Mvondo / BBCPrior to the poll – which will only be a single-round vote as the person with the most votes will win – there had been widespread calls for the opposition to present a single candidate to challenge Biya, who has never lost an election.

Tchiroma Bakary has secured the support of the Union for Change, a coalition of more than 50 political groups and civil society organisations who presented him as the opposition’s consensus candidate.

But the initiative has failed to gain unanimity, with others refusing to rally behind him.

Kamto said he had held talks with some aspirants, including the two northern figures Tchiroma Bakary and Maigari, encouraging them to unite. As neither seemed ready to step down, he urged Cameroonians to vote for whomever they preferred.

Dr Atia reckons the failure to endorse one candidate under a single coalition will cost the opposition at the ballot box.

On the campaign trail, 76-year-old Tchiroma Bakary, a former government spokesperson, has been pulling big crowds – with some analysts positioning the Cameroon National Salvation Front party leader as Biya’s main challenger.

On Sunday, thousands of supporters waited for hours in the rain to see him in the economic capital Douala.

He has promised to reform the system of which he was a part for two decades.

Despite Tchiroma Bakary’s support base in the north, analysts say Biya is likely to overpower him and the other opposition candidates.

“President Biya just needs a slim majority to win the election, and I see him winning despite the efforts being made by the opposition,” says Dr Atia.

Michel Mvondo / BBC

Michel Mvondo / BBCIn Cameroon’s English-speaking North-West and South-West regions, where a long-running separatist conflict continues, an election boycott lockdown has been imposed, paralysing business activities, movement and education.

The separatists who have imposed it have threatened to target anyone who does vote.

“We have seen people [who] have been pulled out of their homes and slaughtered in cold blood, before, during, and even well after [previous] elections when they are identified,” Samah Abang-Mugwa, a resident of one of the Anglophone regions, tells the BBC – adding that he will not risk casting his ballot.

Since 2017, those seeking to create a breakaway state have been fighting government forces. They are angered by what they see as the marginalisation of Cameroon’s minority Anglophone community by the Francophone-dominated government.

The conflict has so far killed at least 6,000 people and forced nearly half a million others from their homes, according to the UN.

According to civil society activist Abine Ayah, the likely exclusion of much of the English-speaking community could undermine the legitimacy of the election.

Although Biya says his government has made significant efforts to resolve the conflict, his opponents in the presidential race continue to criticise his handling of the situation.

After Sunday’s vote, the Constitutional Council has 15 days to announce the results.

The interior minister has already warned that no candidate is allowed to declare victory beforehand.

Paul Atanga Nji made the comments on the eve of the last day of campaigning.

“Those who will attempt to announce results of the presidential election or any self-proclaimed victory in violation of the laws of the republic would have crossed the red line and should be ready to face the retaliatory measures commensurate to their crime.”

Additional reporting by the BBC’s Michel Mvondo in Yaoundé.

More from the BBC on Cameroon’s election:

Getty Images/BBC

Getty Images/BBC

https://ichef.bbci.co.uk/news/1024/branded_news/aa3a/live/e424bf70-a60b-11f0-928c-71dbb8619e94.jpg

2025-10-10 23:12:00